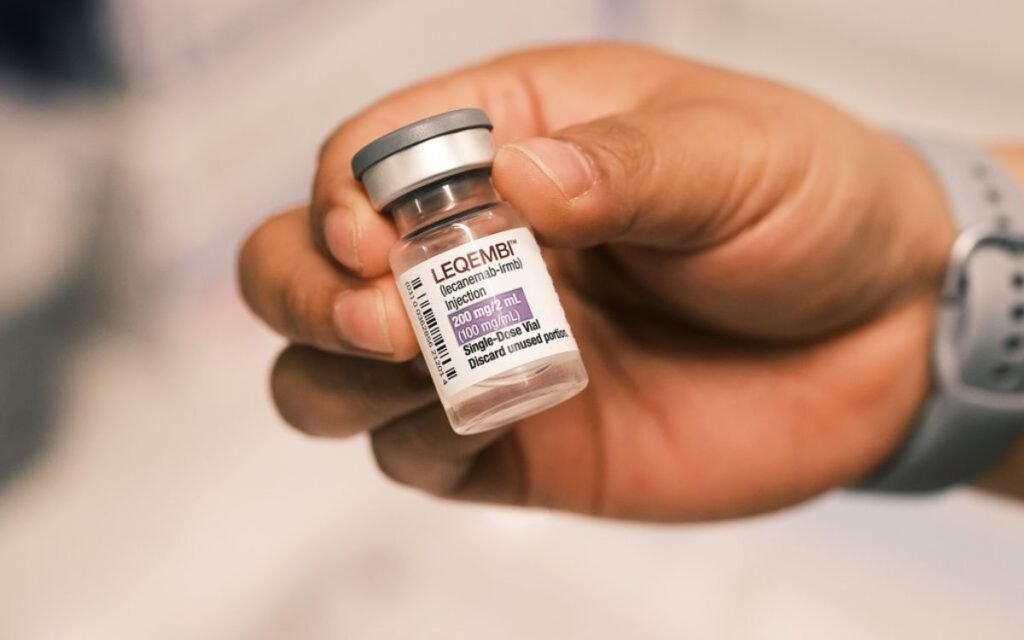

Amid mounting concerns regarding the potential strain on healthcare infrastructure due to Leqembi, a drug for Alzheimer’s disease, Eisai and Biogen have unveiled data on an under-the-skin version of the treatment that could alleviate these concerns.

In a presentation at the Clinical Trials on Alzheimer’s Disease annual meeting, it was revealed that the subcutaneous version of Leqembi demonstrated comparable effectiveness to the FDA-approved intravenous variant in removing toxic amyloid proteins associated with Alzheimer’s. This promising data emerged from an extension of the phase 3 Clarity AD trial, which played a pivotal role in securing FDA approval for Leqembi. The subcutaneous injection, administered to 71 patients who had not previously received Leqembi, showed a 14% higher amyloid plaque clearance in the brain compared to the original version. However, this analysis was preliminary, and there was no data on their respective abilities to slow cognitive decline.

Also Read: How Will Medicare Be Affected By The Cost Of Leqembi From Eisai And Biogen? Sen. Sanders Is Curious

While the efficacy results were encouraging, an important safety metric raised some concerns. Specifically, the subcutaneous Leqembi exhibited a numerically higher rate of amyloid-related imaging abnormalities (ARIA), a known side effect of anti-amyloid antibodies like Leqembi. Rates of brain swelling, referred to as ARIA-E, were 16.7% for subcutaneous and 12.6% for intravenous Leqembi. Rates of minor brain bleeding, known as ARIA-H, were 22.2% and 17.3%, respectively.

ARIA is a potentially life-threatening condition and has been a key consideration when assessing the risk-benefit profile and commercial potential of Leqembi and similar anti-amyloid drugs. Notably, analysts from Mizuho, Leerink Partners, and William Blair all pointed out that the ARIA difference stemmed from a very small number of patients. The safety analysis included 72 patients on subcutaneous and 898 on intravenous Leqembi. One patient in the subcutaneous group who was part of the safety analysis discontinued the trial for reasons unrelated to the medication.

According to Mizuho analyst Salim Syed, describing subcutaneous as worse than intravenous regarding ARIA-E is a matter of “splitting hairs” and is not accurate. The ARIA profiles of both versions are more alike than different. A statistical analysis demonstrated an overlap in the range of true ARIA-E rates between the subcutaneous and intravenous versions.

Also Read: Eisai And Biogen Embark On Full Launch Of Leqembi Following Alzheimer’s Approval

Although the higher ARIA rate was not the outcome Eisai had anticipated, it is worth noting that the steady-state exposure, rather than maximum exposure seen in the intravenous version, is a more reliable predictor of ARIA-E rates in the subcutaneous version. Eisai and Biogen are proposing a self-administered Leqembi as a weekly injection, offering a more stable drug exposure compared to the biweekly intravenous formulation.

Compared to Eli Lilly’s rival candidate, donanemab, the ARIA data for subcutaneous Leqembi appear favorable, according to Syed and the William Blair team. Donanemab is awaiting an FDA decision by year-end.

Eisai and Biogen are preparing to submit an FDA application for the subcutaneous version of Leqembi in the first quarter of 2024. Overall, analysts at Leerink have hailed the latest subcutaneous data as “good news” for both companies. This alternative dosing option is expected to have a similar efficacy-safety profile and could facilitate more convenient at-home dosing, potentially enhancing Leqembi’s commercial prospects.

Also Read: FDA Advisory Committee Vote Validates LEQEMBI Alzheimer’s Treatment

The substantial number of Alzheimer’s patients has raised concerns about the capacity of existing healthcare infrastructure to manage the diagnosis, administration, and monitoring requirements of Leqembi and other anti-amyloid drugs.

Mizuho’s Syed has projected peak sales of $12 billion for Leqembi, even in the face of competition from Lilly’s donanemab. The William Blair team predicts Leqembi’s global revenue in 2030 to reach $8 billion.