For Novo overall, there’s “a lot to be proud of” in 2023’s second quarter, the company’s head of North American operations, Doug Langa, said in an interview.

To begin, Novo has achieved a remarkable 30% surge in sales, reaching 107.7 billion Danish kroner (approximately $15.9 billion). This stands as the “most substantial quarterly growth witnessed in the past two decades,” emphasized Langa, the company’s representative.

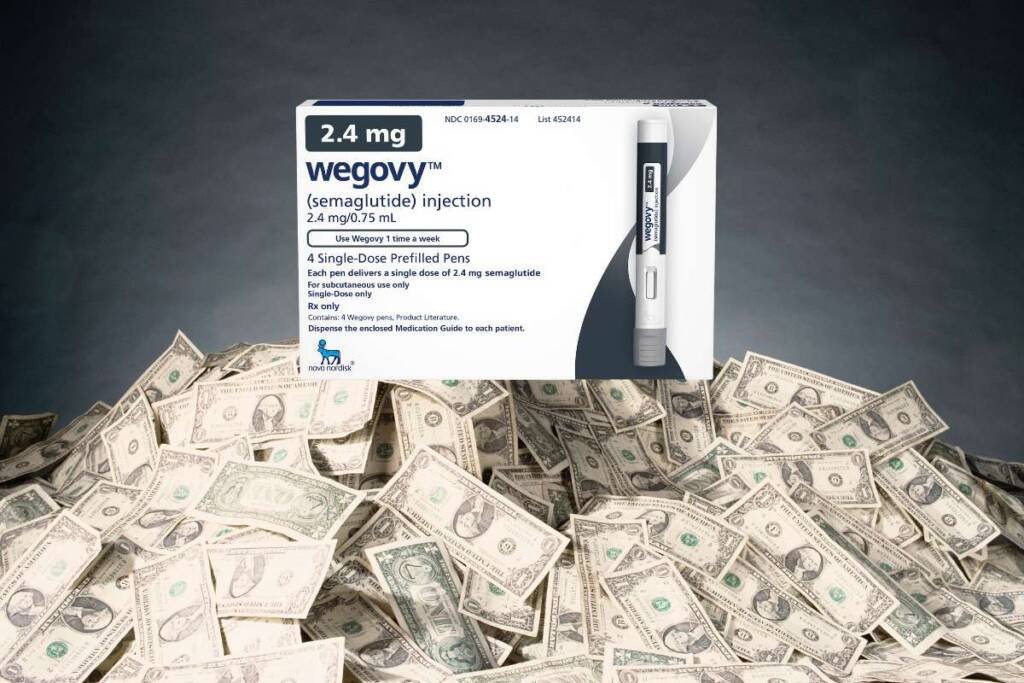

This surge in sales is primarily propelled by Novo’s GLP-1 portfolio, encompassing the prominent diabetes medications Ozempic and Rybelsus, in addition to their newer offering for obesity, Wegovy.

Novo Nordisk Releases Exceptional Cardio Outcomes Data for Leading Obesity Drug Wegovy

For the three-month period, sales in diabetes and obesity care soared by 37% to 99 billion DKK. Specifically, revenues from GLP-1 diabetes treatments witnessed an impressive 50% rise, as stated in a press release by Novo. Notably, the obesity care sector experienced an astounding growth of 157%, amounting to 18.1 billion DKK, with Wegovy contributing a significant 7.5 billion DKK ($1.1 billion). This quarter marks the first instance where Wegovy’s sales have achieved blockbuster status. Novo’s comprehensive obesity care business encompasses both Wegovy and its predecessor in weight loss, Saxenda.

Since its landmark approval for obesity treatment in 2021, Wegovy has garnered immense popularity, leading to occasional challenges in supply for Novo.

Regarding Wegovy’s supply, Langa highlighted that this is a current priority and an area receiving substantial attention from the company. Despite supply limitations, Langa pointed out that Wegovy remains the primary driver of Novo’s growth this quarter.

The demand for the drug is “nothing short of incredible,” he remarked. Langa further noted that the company is actively increasing production and manufacturing all five doses of the drug.

To ensure continuity of care, Novo announced back in May that it was constraining the supply of lower dosage strengths of Wegovy. These supply limitations for starter doses might extend into the next year, according to Novo’s CEO, Lars Fruergaard Jorgensen, as reported by Reuters.

“I must acknowledge that the demand is so strong that even though we are ramping up manufacturing and increasing production, there will be instances where patients flock to the same pharmacies simultaneously, causing shortages.”

– Novo’s CEO, Lars Fruergaard Jorgensen

However, not everyone is equally impressed by Novo’s Q2 performance. Analysts at Oddo BHF characterized the results as “mixed,” while acknowledging the “exceptional performance of the GLP-1 franchise” and underscoring Wegovy’s significance.

Nevertheless, insulin sales in China and the US have continued to be a drag on Novo’s overall performance, the analysts noted.

Having already revised its 2023 sales projection in Q1, Novo is now doing so once again due to the “stronger-than-expected performance of the GLP-1 franchise and Wegovy,” according to the Oddo BHF team.

The company’s updated forecast now anticipates sales growth in the range of 27% to 33%, a significant increase from the initial estimate of 24% to 30% growth.