While several biosimilars of AbbVie’s top-selling drug, Humira, are already available in the US market, only one, Boehringer Ingelheim’s Cyltezo, has achieved the coveted interchangeable status. This designation allows Cyltezo to be switched for the original Humira without the need for prescriber intervention.

Samsung Bioepis and its marketing partner, Organon, now have the clinical data required to seek approval for their biosimilar, Hadlima (also known as SB5), as an interchangeable option. This development aims to give them a competitive advantage in the market for lower-priced copycat therapies.

Hadlima, among several Humira biosimilars launched in the US after the expiration of AbbVie’s patent protection in July, faces stiff competition. Amgen’s Amjevita was the first to reach the market in January, benefiting from a patent litigation settlement with AbbVie, but its sales have remained relatively modest at $51 million in the first quarter of this year.

The once high-flying Humira, with annual sales peaking at $21 billion, has started to show signs of weakness overseas where biosimilars have been available for some time. Predictions indicate a significant decline in sales due to the entry of multiple biosimilars in the US market.

Boehringer Ingelheim and Samsung Bioepis/Organon believe that achieving interchangeable status will differentiate their biosimilar brands from others. Currently, all Humira biosimilars, except for Cyltezo, require a specific prescription from a physician.

To support their bid for interchangeability, Samsung Bioepis and Organon conducted a Phase IV study involving 371 patients with moderate to severe chronic plaque psoriasis. The study demonstrated that switching multiple times between Humira and Hadlima showed equivalence in various pharmacokinetic measures, efficacy, safety, and immunogenicity profiles compared to continuous use of AbbVie’s drug.

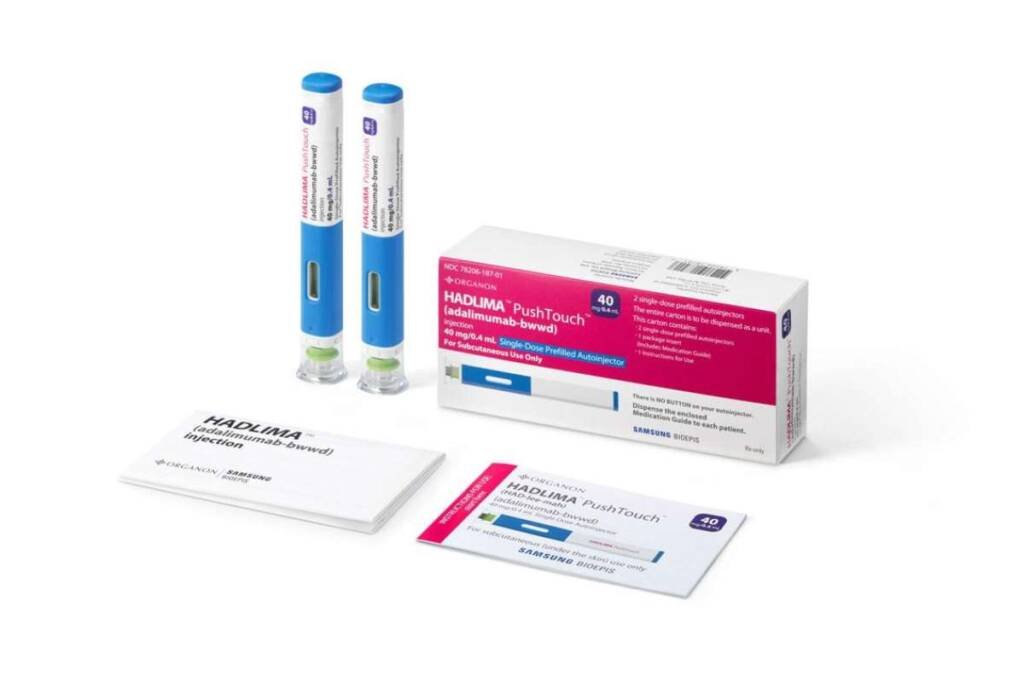

Organon launched Hadlima in July at a significant 85% discount to the brand, with a list price of $1,038 per carton containing two pre-filled pens or syringes. Other biosimilars launched around the same time by Sandoz, Celltrion, Biocon, Pfizer, Coherus, and Fresenius Kabi, creating a competitive landscape.

Despite the availability of Humira biosimilars, it remains uncertain whether prices will significantly decrease, according to Goodroot’s research discussed by industry experts in April.