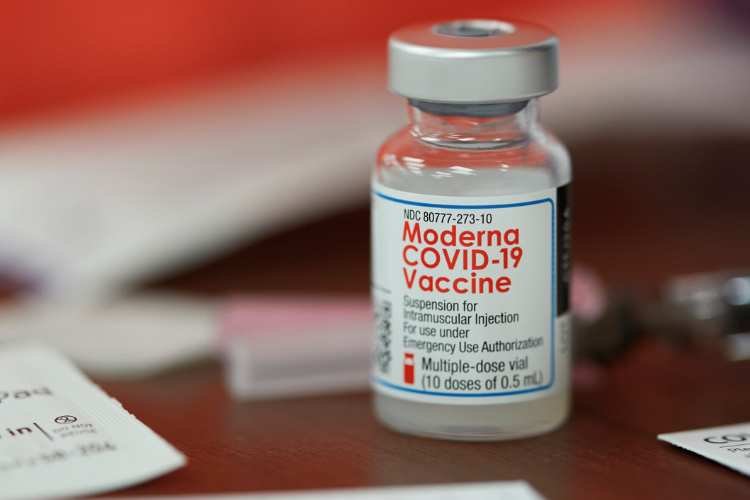

While the FDA and the Centers for Disease Control and Prevention (CDC) have given their green light to updated COVID vaccines for this season, Moderna is gearing up for a future where demand for its vaccine might dwindle.

According to Reuters, Moderna’s President and R&D Head, Stephen Hoge, has revealed that the company is in discussions with its manufacturing partners to reduce the production of its mRNA COVID vaccine, Spikevax, as the world transitions into the endemic phase of the disease.

Hoge explained, “Over the past couple of years, we’ve been in pandemic mode, producing a billion doses a year. We’ve been waiting for the moment when the pandemic was officially behind us that we would need to restructure that manufacturing footprint.”

The talks primarily involve vial fillers, which are integral to Moderna’s production process. Moderna’s manufacturing partners include Thermo Fisher, Catalent, Sanofi, and Lonza, each playing a crucial role in different aspects of vaccine production.

Moderna has already been grappling with declining demand, taking a substantial $674 million hit in the second quarter due to inventory write-downs, idle manufacturing capacity, and the cancellation of purchase agreements, following a $378 million impact in the first quarter.

However, scaling back production won’t be an overnight process. Hoge noted that discussions with contract manufacturers could extend into 2024, emphasizing the long-term relationships necessary for the company’s future.

In anticipation of the 2023 sales outlook, Moderna is projecting revenues between $6 billion to $8 billion, largely dependent on the upcoming season. During the first half of the year, the company reported product sales of $2.1 billion.

This year marks the transition of COVID vaccines into a commercial endemic market, introducing a host of uncertainties. Moderna’s Chief Commercial Officer, Arpa Garay, acknowledged the unique challenges posed by this shift on the company’s second-quarter earnings call.

Previously, Moderna had anticipated approximately 50 million doses of COVID shots being administered in the US this fall. However, drawing parallels with flu shots, Garay suggested that this figure could double to 100 million doses.

Moderna is also facing competition from Pfizer-BioNTech, whose vaccine has garnered more popularity. According to the CDC’s COVID vaccination tracker as of May, nearly 404 million doses of the Pfizer-BioNTech vaccine had been administered in the U.S., compared to almost 253 million doses of Moderna’s vaccine.

As the season gets underway, the FDA has already approved Moderna’s XBB.1.5 shots and those from Pfizer-BioNTech, with the CDC recommending that everyone aged 6 months and older receive the updated vaccines this fall.

In the evolving landscape of COVID vaccination, Moderna is strategically navigating the path forward, adapting to changing demands while maintaining vital partnerships with manufacturers.