Three years ago, Humanigen was on a promising trajectory with a COVID-19 therapy in advanced testing and shares valued at over $20 each. However, the company’s fortunes have taken a sharp turn, and it is now facing the specter of bankruptcy, with its stock firmly relegated to penny share territory.

According to a filing with the Securities & Exchange Commission (SEC), Humanigen had been engaged in negotiations for a reverse merger with an undisclosed privately-held biopharma company. Unfortunately, these talks fell through, and no definitive agreement was reached.

In addition, the company has been unable to secure alternative financing options that would enable it to meet the Nasdaq listing requirements, including maintaining a minimum share price of $1. Consequently, starting today, Humanigen will transition to the OTC Pink Market, which will present further challenges in raising capital.

The situation has been compounded by the resignation of three board members, which has put the company below the minimum threshold required to remain on the main exchange. As a result, Humanigen has informed Nasdaq that it is unlikely to regain compliance.

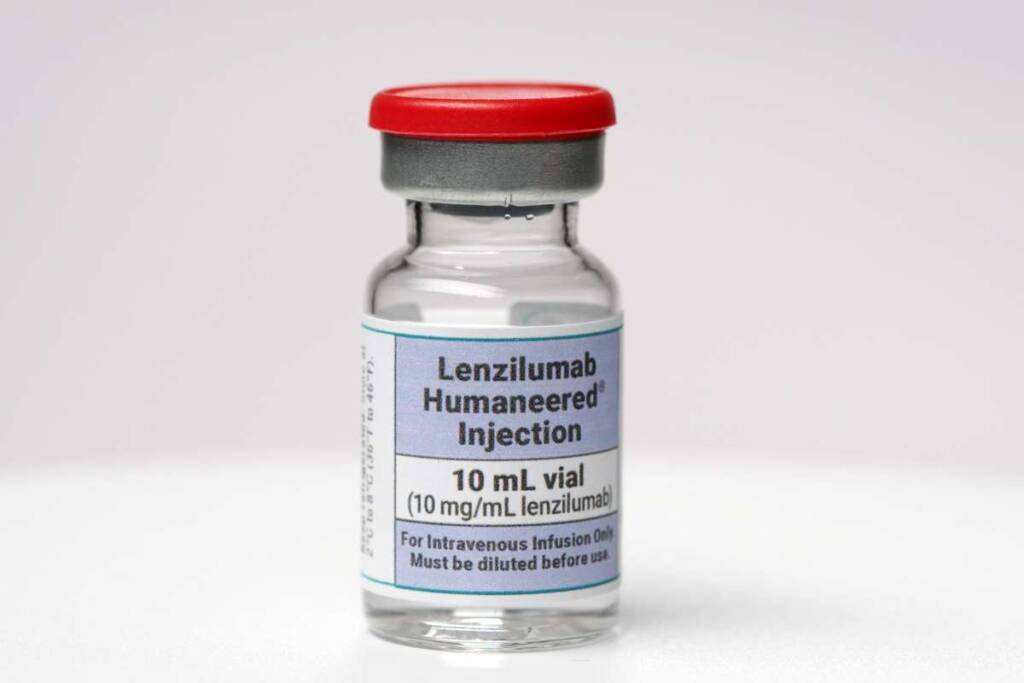

The company’s struggles began when its lead drug lenzilumab, designed to target colony-stimulating factor 2 (CSF2) and granulocyte-macrophage colony-stimulating factor (GM-CSF), failed to produce desired results in a Phase III trial for COVID-19 patients hospitalized with the disease. Initially, Humanigen had hoped for emergency use authorization by the end of 2020, aiming to combat the cytokine storm that can lead to severe respiratory distress syndrome in some COVID-19 patients.

Unfortunately, the FDA rejected the application towards the end of 2021, dashing those hopes. Subsequent efforts to repurpose the drug for other indications, such as an add-on therapy for CAR-T treatments in non-Hodgkin’s lymphoma, chronic myelomonocytic leukemia, and graft versus host disease, did not yield successful outcomes.

As of the last financial statement in March, Humanigen’s cash reserves had dwindled to just over $3 million from approximately $10 million at the end of 2022. Now, the company is exploring the possibility of selling its remaining assets through bankruptcy proceedings, which could lead to a significant loss in value for its shareholders.

Consequently, the value of the company’s shares has plummeted by over 80%, dipping below 4 cents per share as of the recent trading.