Since the FDA gave the green light to Novo Nordisk’s GLP-1 weight-loss medication Wegovy over two years ago, the drug has been a focal point of anticipation for analysts and investors. Novo’s financial disclosures for the third quarter provide a more detailed picture of this blockbuster’s performance.

In the first nine months of 2023, Novo Nordisk reported global sales of 166 billion Danish kroner (around $23.65 billion), marking a 33% increase compared to the same timeframe in the previous year.

The surge in sales is largely attributed to the company’s diabetes and obesity care sector, which witnessed a 40% growth to reach 153.8 billion kroner (approximately $21.91 billion).

Within this sector, the obesity care segment has been the powerhouse of growth, soaring by 174% at constant exchange rates to 30.4 billion kroner (about $4.33 billion) fduring the year’s first nine months.

Also Read: Eli Lilly Expands Manufacturing To Meet Mounjaro Demand Surge

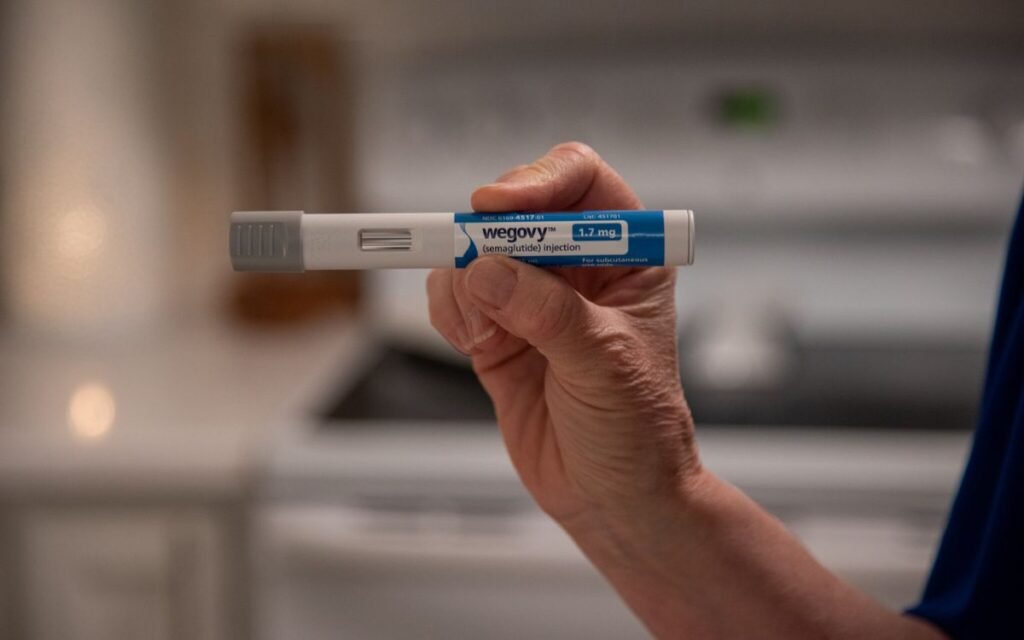

Wegovy, introduced in 2021, stands out within the segment, accumulating sales of 21.72 billion kroner ($3.09 billion) in this period.

Despite ramping up production, Novo Nordisk anticipates that the demand for Wegovy will continue to exceed the supply, as stated by CEO Lars Fruergaard Jørgensen during a press briefing as reported by The Financial Times and Reuters.

Earlier in the year, in response to the demand surge, Novo Nordisk moderated the US market introduction of Wegovy by limiting the availability of starter doses to ensure continuous access for ongoing patients.

These restrictions will persist in the US even as the company gradually increases the production of Wegovy, according to Doug Langa, head of Novo’s North American operations, during an investor conference.

This cautious approach will also shape Novo’s market entry strategy for Wegovy internationally, with plans to regulate the volumes to ensure a sustainable launch, added Langa.

Also Read: Leading Obesity Medication Wegovy’s ‘Best-Case Scenario’ Novo Nordisk Published Cardiac Results Statistics

Looking to 2024, Novo Nordisk anticipates a substantial boost in volumes for the US market compared to 2023, noted Novo’s CFO Karsten Munk Knudsen on the earnings call.

However, Knudsen tempered expectations for a dramatic surge, predicting a steady escalation in supply, initially focusing on lower doses before increasing them progressively.

Concurrently, Novo is witnessing a boom in its GLP-1 segment, while its rare disease product sales have dropped by 18% to 12.6 billion kroner ($1.8 billion), which the company attributes to a temporary decrease in manufacturing capacity. This has impacted sales of Norditropin, a treatment for rare endocrine disorders, which saw a 54% reduction to 2.57 billion kroner ($370 million) over the nine months.